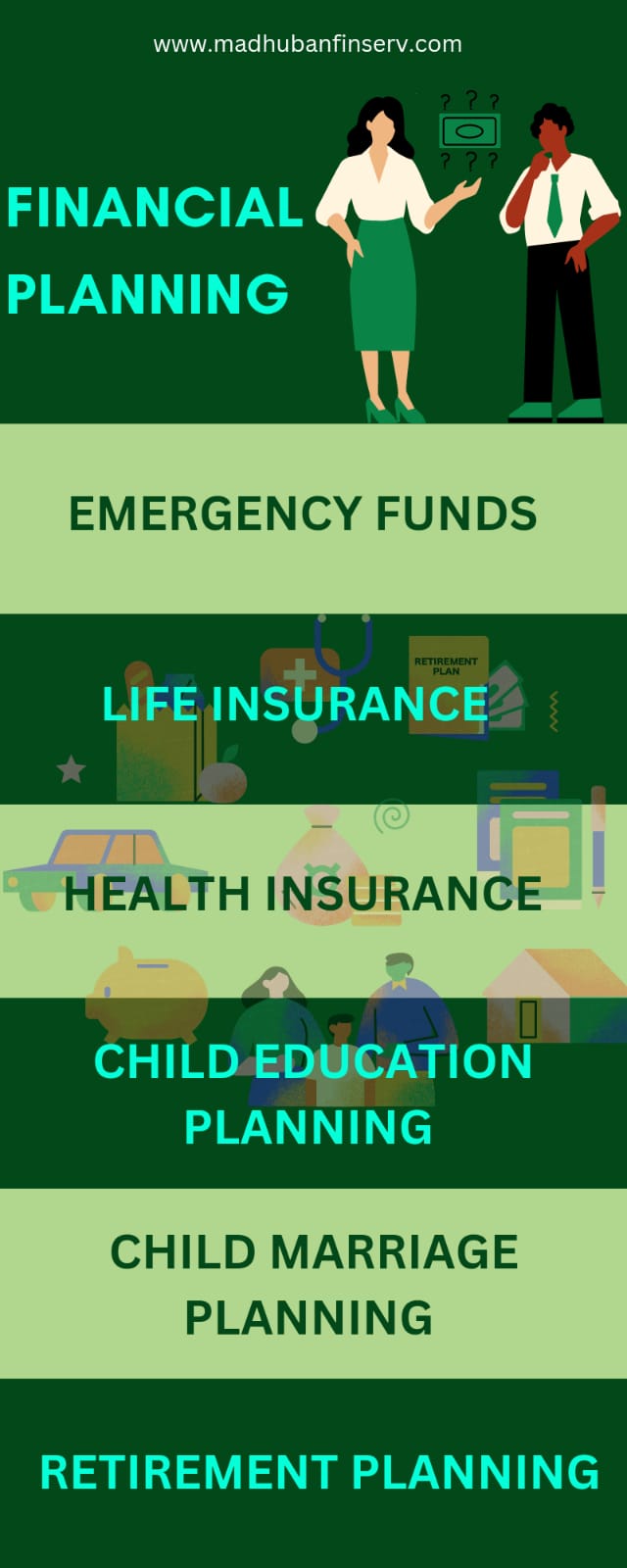

Child Marriage Planning

It is the dream of every parent to get their child married. The whole life's earnings are spent on the expenditure of marriage. At that time, we should not need any loans or borrowing. For that reason, we should start saving and investing as early as possible so that the money has time to grow into a sufficient corpus. You should choose investments that provide returns above inflation over the long term. Long-term investment planning helps parents to build a strong financial corpus for their children, be they a girl or a boy. The amount can be used for marriage. Investment planning for children's marriage should be started only when the children are young.

Retirement Planning

Retirement planning is important for us to live our old age with dignity, and we should not depend on our future mainly on our children. Retirement planning is for our future life so that we can pursue all our goals and dreams independently.

Financial Planning

Madhuban Finserv believes that if you do proper financial planning in your life, you will never need to borrow money or take a loan from anyone. Some situations often come in our life. its solutions are as follows.

Emergency Fund

Sometimes a sudden time comes in our life when we withdraw our savings at some point in time. For example, when we don't have a job for a while. Due to recession in business. Locked down due to Corona. Medical emergencies etc. These are the instances when we withdraw our savings. To avoid this situation, we do not require you to withdraw your savings, which we did for some purpose. For this, we should have an emergency fund to help us in these situations.

Life Insurance

Life insurance is very important in our life. Life insurance guarantees financial security to our family which we love so much. If the earning member of the household whose income supports, the expenses of the entire household. If he dies suddenly, along with loss of life, the whole family also suffers a financial loss. Because the way of income of the whole family is closed. Because on that earner only the expenses of the whole family run. Life insurance protects us from this financial loss. For this, we must have a life insurance policy. Term Insurance Best Option.

Health Insurance

Health Insurance protects The Savings that we must save for our future dreams. Health Insurance protects against sudden expenses due to illness and accidents. For this, we must have a health insurance policy. A Floater policy is the best option for a family.

Child Education Planning

Education is the foundation of a child's future well-being. Children's education creates various opportunities to help them live better lives. Every parent wants their child to become a doctor and engineer etc. Nowadays, a lot of money is needed for the higher education of children. For which parents take education loans. We should start investing at the time of the child's birth so that we do not need an education loan at that time. A child education plan allows systematic savings by the parents to ensure their child's future. This helps guarantee a safe path for the child to achieve their dreams, even if the parent is not around for unforeseen reasons.